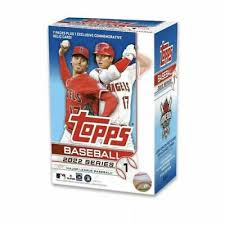

When Fanatics acquired Topps in 2022, the hobby held its collective breath. Would the sports merchandise giant maintain the quality and traditions that made Topps baseball cards the cornerstone of collecting for over 70 years?

The first couple of flagship releases under the new company saw some changes. Some positive and others not so much.

But overall, there is a feeling that the general direction is not particularly promising.

With the release of 2025 Topps Series 1, we’re seeing significant changes that have left many collectors questioning the direction of the flagship product.

Join us for a deep dive into the problems with 2025 Topps Series 1.

Remember when parallels actually meant something? These days, 2025 Series 1 is serving up more parallels than a geometry textbook, and most of them are about as exciting as watching paint dry in a rain delay.

What’s worse? They’ve axed the black parallels – you know, the ones people actually wanted – and replaced them with variations that’ll have you reaching for your reading glasses just to spot the differences.

It’s like Topps is playing a twisted game of “Where’s Waldo?” but instead of finding a guy in a striped shirt, you’re hunting for microscopic foil pattern changes.

The parallel lineup reads like a Baskin-Robbins menu designed by someone who’s never eaten ice cream. You’ve got your Advanced Stats (/300), your Independence Day (/76), and enough rainbow foil variants to make a unicorn jealous.

But here’s the real kicker – with print runs higher than a Little Leaguer’s pitch count, even the numbered parallels are losing their luster faster than a chrome card left in the sun. The hobby used to get exclusive parallels that actually felt, you know, exclusive.

Now? The odds of pulling something meaningful are lower than the Marlins’ playoff chances. When your “rare” parallel is so common that card shops are using them as coasters, maybe it’s time to dial back the parallel printer.

But hey, at least we can look forward to explaining to future collectors why a card numbered to 2,025 was considered “limited.” Spoiler alert: it wasn’t.

Let’s talk odds, because these numbers are more depressing than a Cleveland Browns highlight reel. Advanced Stats parallels, which used to be a chase card worth pursuing, are now numbered to 300 – and that’s supposed to be one of the “rare” parallels.

The Rainbow Foil parallels are falling at 1 in 10 packs, which means you’ll probably pull enough of them to wallpaper your man cave.

And those Independence Day parallels numbered to 76? With the print run of Series 1 being what it is, that means there are still thousands of “rare” parallels floating around out there.

The parallel rainbow has gotten so bloated, you need a spreadsheet just to keep track of what you’re pulling. Remember when getting a parallel meant something?

Now it just means you opened a pack. Congratulations, I guess.

Perhaps the most contentious change is the treatment of the popular All Aces insert set. Previously available across multiple product lines, All Aces cards are now a hobby and jumbo exclusive, with pull rates lower than one per case.

This decision has effectively priced out many collectors who rely on retail products for their collecting journey. The move reflects a growing trend in the industry: creating artificial scarcity through exclusive parallels and inserts.

While this strategy might boost short-term sales among deep-pocketed collectors, it risks alienating the broader collecting community that has sustained the hobby for generations.

Let’s talk about the elephant in the room: the 2025 Topps Series 1 design is as inspiring as a backup catcher’s batting average. The stencil-style player names look like someone forgot to finish coloring them in, giving the cards an incomplete feel that’s harder to ignore than a Yankees fan at Fenway.

It’s as if Topps handed their design team an Etch A Sketch and said, “Hey, just do whatever.”

But the real kicker? Those black hexagon shapes on the card backs are chipping faster than a Little League pitcher’s confidence. When collectors already plan their PSA submission strategies around design flaws before release day, you know something’s gone wrong.

The base design itself feels like it was created by someone who’s heard of baseball cards but has never actually seen one. It’s technically functional, sure, but so is a paper bag uniform, and nobody’s asking for that.

Even hobby veterans who typically defend Topps’ creative choices are scratching their heads. “It’s like they’re actively trying to make Chrome look better by comparison,” quipped one prominent card shop owner, and honestly?

He might be onto something. When your flagship product has collectors pining for last year’s design like it was the 1952 Topps set, it might be time to go back to the drawing board. Or at least find where they stored the good designs because this isn’t it, chief.

If you plan to submit your 2025 Topps Series 1 cards for grading, let’s sit down for this one. The latest Topps release has a design flaw that’s about as welcome as a rain delay in Game 7 – those black hexagon shapes on the card backs are chipping faster than a Vegas poker player with rent money.

And we’re not talking about minor wear here; we’re talking about the kind of chipping that makes PSA graders reach for the aspirin.

The problem is particularly maddening because it’s entirely self-inflicted. Topps, a company that has been making baseball cards since Harry Truman was in office, somehow approved a design element that is as durable as a sandcastle at high tide.

The black hexagons in the top corners of the card backs show wear straight out of the pack – before they’ve even encountered a penny sleeve. For modern card collectors who’ve become increasingly focused on grading, this is like finding out your “game-used” jersey card came from a mascot costume.

It’s excruciating, considering that many collectors rely on graded cards as investments, and nothing tanks a card’s value like a design destined to chip.

When your best storage option is “never touch the cards and maybe don’t even breathe near them,” you know Topps has spectacularly fumbled the quality control ball.

In an era where print runs can make or break a product’s success, 2025 Series 1 faces criticism for being “way overprinted,” according to multiple hobby sources. This abundance of supply, combined with what many consider a weak rookie class, has created concerns about long-term value retention.

Let’s talk numbers because the 2025 Series 1 production gives the “junk wax era” a run for its money.

According to Sports Illustrated, hobby boxes are hitting the market at $90 MSRP, with cases running $1,080 – but here’s the kicker: Blowout Cards is already advertising them at $49.25. When your flagship product is discounted 45% before it even hits shelves, you might have a supply problem that makes the Federal Reserve look conservative with their money printer.

The configuration tells the whole story. We’re looking at 12 cards per pack, 20 packs per hobby box, and 12 boxes per case. Multiply that by the number of cases flooding the market, and you’ve got enough cardboard to build a life-size replica of Yankee Stadium.

The real gut punch? Despite having what could be one of the most loaded rookie classes in years – including Chourio, Holliday, Merrill, Langford, Skenes, Imanaga, and Yamamoto – Topps is treating these cards like they’re printing Instagram photos. When hobby shops plan markdown strategies before the release date, you know we’re in trouble.

At this rate, these cards will be about as rare as a Yankees fan with an Aaron Judge jersey – and about as valuable as your grandmother’s 1991 Fleer collection.

The irony isn’t lost on collectors: while specific inserts and parallels are more difficult to pull than ever, the base cards may be too readily available. This dichotomy highlights the challenging balance between maintaining value and keeping the hobby accessible to casual collectors.

In what can only be described as a head-scratching move, Topps has taken an axe to some of the hobby’s most beloved parallel cards in their 2025 Series 1 release.

Eliminating black border parallels – a collector favorite that has traditionally added visual appeal and chase value to the set – feels like watching your favorite player get traded for cash considerations. But that’s just the beginning of what’s been stripped away.

Removing Mother’s Day and Father’s Day parallels is particularly hard for collectors. These weren’t just unique variations; they were traditions.

For years, collectors have hunted these pink and blue beauties, often sharing pulls with their parents or using them to introduce their kids to the hobby.

“These parallels meant something,” says veteran collector Mike Thompson in a recent hobby forum discussion. “They weren’t just different colored cards – they were conversation pieces that connected generations of collectors.”

The decision to discontinue these parallel sets has left many long-time collectors feeling like Topps is gradually dismantling the very elements that made their products special in the first place.

Combined with the underwhelming base design and quality control issues, these changes have caused many to wonder if the hobby giant has lost touch with what collectors want.

The timing couldn’t be worse. With the hobby already facing rising prices and market saturation challenges, removing fan-favorite elements feels less like streamlining and more like cost-cutting.

Some collectors have even started referring to 2025 Series 1 as “The Great Parallel Purge,” a nickname that would be funny if it weren’t so accurate.

This feels like a significant misstep for a company that built its reputation on tradition and collector satisfaction – with many collectors reaching for their 2024 cards instead.

If you’re considering diving into the 2025 Series 1, let me save you some time and money: skip the retail like you’d skip a blind date with a Red Sox fan. Despite their flaws, Hobby boxes are the only way to fly this year.

Here’s the deal: while hobby boxes give you one guaranteed hit per box, retail looks as promising as a pitcher’s batting average. The retail configuration is so watered down that you’d have better odds of finding Bigfoot than pulling something significant.

We’re talking hit ratios that would make a Vegas slot machine blush. Even the parallel odds in retail are brutal – you could probably read “War and Peace” faster than you could pull a decent parallel from retail packs.

But it gets better (or worse, depending on how you look at it). The hobby boxes at least give you a fighting chance at the good stuff – autographs, relics, or those sweet, sweet image variations with some value.

Retail? You’re paying for the privilege of pulling base cards worth less than the wrapper they came in. And let’s talk about card stock quality – hobby gets the premium treatment, while retail feels like it was printed on recycled pizza boxes. When your best pull from a retail box is “it didn’t bend in the pack,” you know you’re in trouble.

Save your money for a hobby… or better yet, singles.

These changes arrive at a crucial moment for the hobby. After the pandemic-era boom and subsequent market adjustment, the industry needs products that can sustain long-term interest while providing genuine value to collectors. The decisions made with 2025 Topps Series 1 raise questions about whether Topps is striking the right balance.

The set’s issues reflect broader tensions in the hobby: exclusivity versus accessibility, scarcity versus availability, and investment potential versus collecting enjoyment.

While some changes might boost short-term sales or create buzz around certain cards, they risk undermining Series 1’s fundamental appeal as baseball card collecting’s flagship product.

Despite these challenges, it’s worth noting that Topps Series 1 remains a cornerstone of the collecting calendar. The question isn’t whether collectors will continue buying – they will – but whether the product will maintain its unique place in the hobby’s heart.

Some positive changes are worth acknowledging. The card stock quality has improved over previous years, and the photography showcases baseball’s most exciting moments.

However, these improvements are overshadowed by decisions that seem to prioritize artificial scarcity over collector satisfaction.

For collectors approaching 2025 Series 1, consider these strategies:

The issues surrounding 2025 Series 1 might represent growing pains as Fanatics continues to shape Topps’ future direction.

However, they also warn about the risks of straying too far from what makes baseball card collecting unique: the joy of opening packs, the thrill of completing sets, and the ability to participate regardless of budget.

As we progress, the hobby’s health will depend on finding a better balance between creating value for investors and maintaining accessibility for collectors. The response to 2025 Series 1 suggests we haven’t seen that balance yet.

For now, collectors face a choice: adapt to or resist these changes. Either way, the conversation around 2025 Series 1 will likely influence the direction of future releases. In the end, the success of any trading card product isn’t just measured in sales figures but in its ability to sustain and grow the collecting community.

Whether Topps will adjust its course based on this feedback remains to be seen. What’s clear is that the hobby is watching closely, ready to voice its opinions about the future of its beloved flagship product.

After all, Series 1 isn’t just another release. It’s the heartbeat of the hobby. When that heartbeat feels off, we all feel it.

2025 Topps All Star Game Mega Box Product Review

Ripping the new Topps All Star Game mega box.

Is this new sports card store the BEST VALUE around?

I Tested eBay Auction Promotions So You Don’t Have To!

I deep-dove on Fanatics Collect so you don't have to (but should you?)

Panini is launching a WNBA Product at $30,000!?

Topps Chrome 2024-25 Basketball: Honest Review and Notes

Did you know this SECRET about PSA slabs? #sportscard #tcg

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

Keep up on breaking Sports Card News, our latest articles, product specials and exclusive content with expert analysis of hobby trends.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

The Ultimate 2024 Football Card Brand Tier List (Panini vs. Topps and more!)

Cardlines 8 hours ago