In surprise news revealed on Tuesday, Beckett Media & Collectibles is now under the umbrella of Collēctīvus Holdings. With all the trouble at BGS, it sounds like encouraging news that it will be under new management.

But looking deeper into this story, there seems to be something strangely familiar about the new ownership. Indeed, it looks very similar to the previous one.

So what is going on? Our coverage covers the full story of the new BGS holding company.

On December 17, 2024, it was announced that Beckett Media & Collectibles had been sold to a new holding company called Collēctīvus Holdings.

They have announced this news as part of a broader play involving ownership of two other companies: the Dragon Shield accessories company and the Southern Hobby Distribution Company.

The CEO of Collēctīvus Holdings, Kevin Isaacson, said, “We’re thrilled. It’s truly a new beginning. We enter 2025 with an incredible team of dedicated hobbyists, motivated investors, and a dedicated customer base that appreciates our 100+-year commitment to success across the Beckett, Dragon Shield, and Southern Hobby companies.”

Beckett has been seriously struggling for quite some time. It was clear that something had to give to the company, or it would simply become irrelevant to the hobby.

When a new owner purchases a company with a long history, the first thing they do is reassure everyone that there won’t be any significant changes and that the company will maintain its independence. This new deal is no exception.

According to the official statement from the company, “All brands under the Collēctīvus banner will maintain their independence and identities, but they will now benefit from an added layer of coordination and strategy from a global leadership team.”

However, in this case, there is reason to believe that the folks at Collēctīvus Holdings actually mean it. Not least of which is the fact that the same people are running it.

You are not alone if you have heard of this organization. It is a brand new company that has become part of this deal and is now positioned to become an significant actor in the hobby.

The new CEO, Kevin Isaacson, has worked for Beckett for quite some time. He was CEO from May 2023 to the present and has now received a promotion to head Collēctīvus Holdings.

He has a ringing endorsement on his LinkedIn from Victor Shaffer, the Executive Vice President at Fanatics: “Kevin is incredibly fair-minded in all that he pursues. He can work with “opposing parties” in many circumstances and still find a way to create a “win-win. “Kevin operates with the utmost integrity, and I will look forward to working with him again, and again, and again.”

Meanwhile, the Chief Marketing Officer of Collēctīvus Holdings is also the CMO of Beckett Holdings. So, there is not exactly a significant shift in management here.

The Collectivus Holdings website is sparse. It says simply: “Collēctīvus Holdings oversees the most prestigious brands in the Collecting, Trading Card Game, and Hobby industries. With a century of combined expertise in pioneering products, delivering exceptional quality, and enhancing customer experiences, Collēctīvus is synonymous with excellence. Its brands are globally celebrated and cherished by the communities they serve.”

“Our mission is to connect the world of collecting and gaming through brands that deliver quality, integrity, and reliability. Together, Beckett, Dragon Shield, and Southern Hobby work to enhance the hobbies and passions that bring people together.”

The company is so new that the social media links on its website take you to those of Beckett.

Collēctīvus Holdings tooted their own horn in the press release they provided regarding the purchase:

“It’s rare for a brand to establish itself as the industry leader right from its inception, but that’s exactly what Collēctīvus is doing,” said Scott Stroud, CMO of Collēctīvus Holdings.

“When you look across the three Collēctīvus brands, you find the most sought-after labels in all collecting, the highest quality sleeves in TCG, and the most knowledgeable sales team in The Hobby. With the added ability to further invest in all our brands, 2025 looks like a record year.”

Beckett was once the biggest name in the hobby. But in recent years, a string of misfortunes has tarnished their name and erased their impact on the hobby, which has grown significantly.

In November, Greg Lindberg, the CEO of Global Growth, which owned Beckett, pled guilty to fraud and money laundering to $2 billion.

According to court documents, he “conspired with others to defraud various insurance companies, other third parties, and ultimately thousands of insurance policyholders.” The US Justice Department stated that he “created a complex web of insurance companies, investment businesses, and other business entities and exploited them to engage in millions of dollars of circular transactions. Lindberg’s actions harmed thousands of policyholders, deceived regulators, and caused tremendous risk for the insurance industry.”

Lindberg has admitted to some severe charges. As a result, he faces up to ten years in prison. He also owes $580 million to NC Mogul Lands and is involved in a legal dispute in the Delaware Courts over that debt.

The legal and financial trouble that Lindberg and Global Growth have found themselves in has reflected in BGS’s well-being.

It is one of the main reasons the company has appeared to fade and cease providing a serious alternative to PSA listlessly.

When the CEO of a company pleads guilty to serious charges, as Lindberg has done, it can be a severe blow to the company’s image. But in this case, the damage appears to have been far more direct and material than that.

On June 6, 2024, Scott Roskind, the CEO of Noxx Technologies, a company BGS purchased in 2022, filed a lawsuit against Lindberg.

Roskind was also made BGS’s Chief Vision Officer as part of the deal. NoXX was supposed to become a social media platform for sports card collectors. That did not pan out, and today, you can buy the domain, which used to be Noxx, for a mere $4,995.

Roskind alleges that his company failed because BGS used it as part of a wider scam wherein “concealed monolithic orchestrated and complex enterprise consisting of 10 different companies (hereinafter referred to as the “Lindberg Enterprise”) operated to wrongfully siphon off funds and assets from victims such as Plaintiff and the Stakeholders for the benefit of Defendants and related affiliated persons.”

Roskind alleges that his company’s NoXX purchase was not based on misrepresentation. Lindberg had assured Roskind that he had sufficient capital on hand to purchase NoXX on hand.

However, court documents say “that statement was not true.” Instead, “Beckett used the NoXX acquisition, at least in part, to secure a multi-hundred million dollar line of credit used to close the deal to transform the business and make it tech-enabled.”

That money was allegedly used not for Beckett’s business purposes but instead went elsewhere. The filing states, “Beckett received only 500k of the 100 million raised.”

The rest of it went to Southern Hobby and Global Growth.

The allegation is that BGS bought NoXX “to increase the value of the business and other Beckett Group portfolios and sell off the group to help Global Growth’s ongoing legal battle. However, the market turned, and Beckett could not sell their company.”

The indication here is that the hobby bubble popped, and the value of BGS was lower than it once was.

Among those defendants is not only Lindberg but also Kevin Isaacson. Yes, the same Kevin Isaacson who is now the CEO of this mysterious new conglomerate, Collēctīvus Holdings.

The charges are unproven, and Lindberg and Isaacson are innocent until proven guilty. However, Lindberg has been convicted of skimming money off the top from other companies. So, there is a disturbing pattern of behavior to account for.

The case has not been resolved and likely won’t be for some time. However, it shows that BGS and Global Growth are directly involved in some dealings that have gotten Lindberg into trouble. It is not surprising that BGS wants to distance itself from that.

The legal issues BGS faces are significant and could just be starting. We don’t yet know the full fallout from the Linberg affair. However, the brand has other problems—more normal ones that many failing companies face.

They could be related since the company brass may have been more busy dealing with different things rather than the company’s well-being.

The company’s trouble started during the COVID boom. They shut downgrading operations for months as they were overwhelmed with submissions. But while PSA used that time to improve its facilities and hire more people, BGS did not.

When they announced that “All orders submitted under the Express, Standard, and Economy level will be returned to the customer, ungraded, this decision allows us to focus on our growing backlog and get as many cards back to customers as possible before the National. This is not ideal for anyone, but our competition has done it. We now feel this is the right move for Beckett. Again, this will be temporary, and we believe it will improve our availability for the remainder of 2021 and 2022.”

They never recovered the ground they lost at that time. They should have used that time wisely to improve their services and capacity as PSA did.

The company fell behind PSA and SGC and became an also-ran in the grading business.

In 2023, BGS announced that it was changing its grading scale. Beckett’s main selling point had long been its Black Label Pristine cards, which (at least theoretically) had the highest standards of any grade in the business. That meant that owners of Black Label cards could charge a significant premium for these items.

But the proposed changes were designed to erode that advantage. We explained the changes at the time: “A Gem Mint would now be any card with at least one 10 subgrades and no other subgrade lower than 9.5 sub-grades. A card meeting these qualifications would now be considered a Gem Mint 10. The move doesn’t seem dramatic at first glance. However, it takes away one of the main unique selling points of the BGS brand. Until now, Beckett cards with 9.5 were considered Gem Mint and thus equivalent to a PSA 10 or SGC 10.”

BGS users and owners of Black Label Pristine cards were outraged at the change. After all, it would significantly devalue their holdings. BGS quickly gave up on the changes and folded like a cheap suit.

If that was not enough, BGS has been involved in some scandals recently. They graded a clearly fake Michael Jordan PMG card. In addition, ALT sued BGS for grading a trimmed card.

These are just two of several incidents that have given BGS a reputation for being more easily fooled than the other grading companies. That is probably because they have not invested in hiring the best talent.

A lack of adequate personnel has also led to serious problems with turnaround at BGS. They are considered the most unreliable regarding timetables for cards sent to them for grading.

With all these problems in the background, I recently published a piece on BGS’s trouble.

A disproportionate number of the submissions they received were Topps Now and Bowman U Now cards people sent, hoping they would get a Black Label designation because that release is better printed and does not come in a pack.

The more I look into this news, the more it seems like a simple act of rebranding. The BGS brand has been in severe decline for a significant time. This reshuffling has created positive headlines for them and allowed BGS to put some positive press releases out there.

However, I do not see any evidence of actual change involved. The most significant indication is that there are no notable personnel changes.

The two people on the press release, Scott Stroud and Kevin Isaacson, worked for BGS before this move and in the same capacities. Indeed, their LinkedIn profiles do not even register a change of employer.

There is also no evidence that the “new” ownership comes with a new flow of capital. That is what BGS needs. More money is required to improve its facilities, graders, and turnaround time.

It also needs new management who is not involved in the Lindberg scandals and the flagrant mismanagement that has plagued the company since.

The urge BGS has to distance itself from Lindberg and Global Growth is very understandable. But it appears that they need to go further.

In particular, keeping Kevin Isaacson in charge and even giving him a promotion (at least theoretically) is a very problematic proposition. The invention of a new entity that has suddenly popped out of nowhere and is run by the same people will fool no one.

BGS has remained the same, and the same people who have run the company into the ground continue to be at the helm.

I hope to be wrong, but the creation of this new entity, Collēctīvus Holdings, seems like a fairly desperate attempt to turn the corner for BGS without any real change.

I hit a SWEET auto from the #1 overall pick at PCB hobby

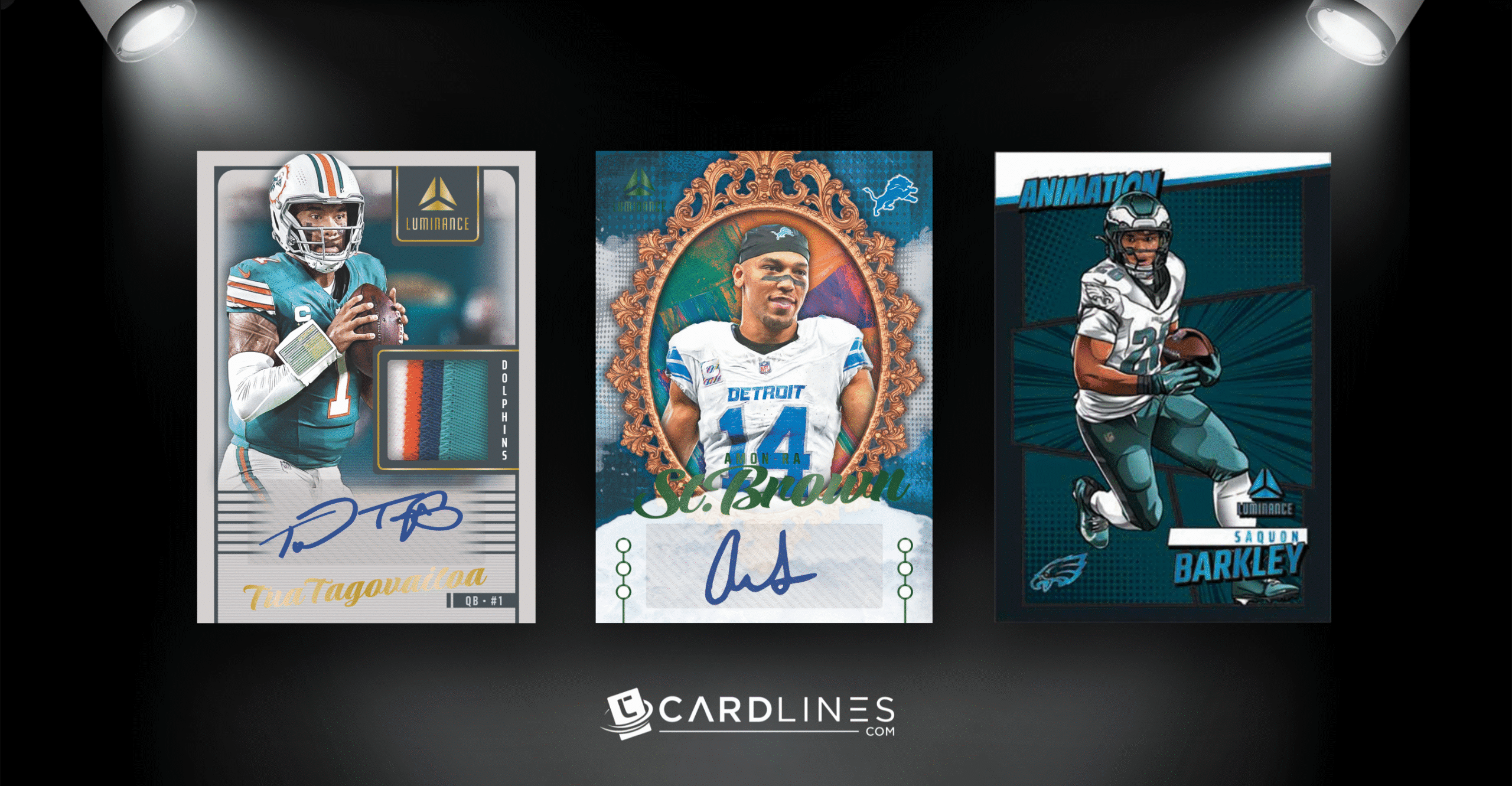

The Ultimate 2024 Football Card Brand Tier List (Panini vs. Topps and more!)

2025 Topps All Star Game Mega Box Product Review

Ripping the new Topps All Star Game mega box.

Is this new sports card store the BEST VALUE around?

I Tested eBay Auction Promotions So You Don’t Have To!

I deep-dove on Fanatics Collect so you don't have to (but should you?)

Panini is launching a WNBA Product at $30,000!?

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

Keep up on breaking Sports Card News, our latest articles, product specials and exclusive content with expert analysis of hobby trends.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

Sports Card Scavenger Hunt! (5,000 Subscriber Special!)

Cardlines 11 hours ago