We all knew a Topps baseball NFT was coming, and now it is here. The company will release the Topps’ MLB NFT will be released on April 20th.

The upcoming Topps product is not the first baseball NFT out there. Panini has baseball cards on their Blockchain store. However, the product is not licensed and therefore does not contain MLB logos.

Topps enjoys an exclusive license with MLB, sealed and guaranteed until 2025. Therefore, the NFT’s are a fully licensed product. That makes them far more attractive to many baseball fans.

The Topps NFT will emphasize and facilitate trade more than Top Shot does.

The vision for the set is at once more extensive than Top Shot while also remaining more traditional. While Topps’ MLB NFT will contain highlights (what Top Shot calls Moments), it will also feature traditional-looking NFT cards.

The Topps website’s screenshots indicate that the Topps’ MLB NFT will emphasize trades, unlike the Top Shot model. In that way, it will probably be more similar to Upper Deck’s e-pack model, which is quite trade-friendly.

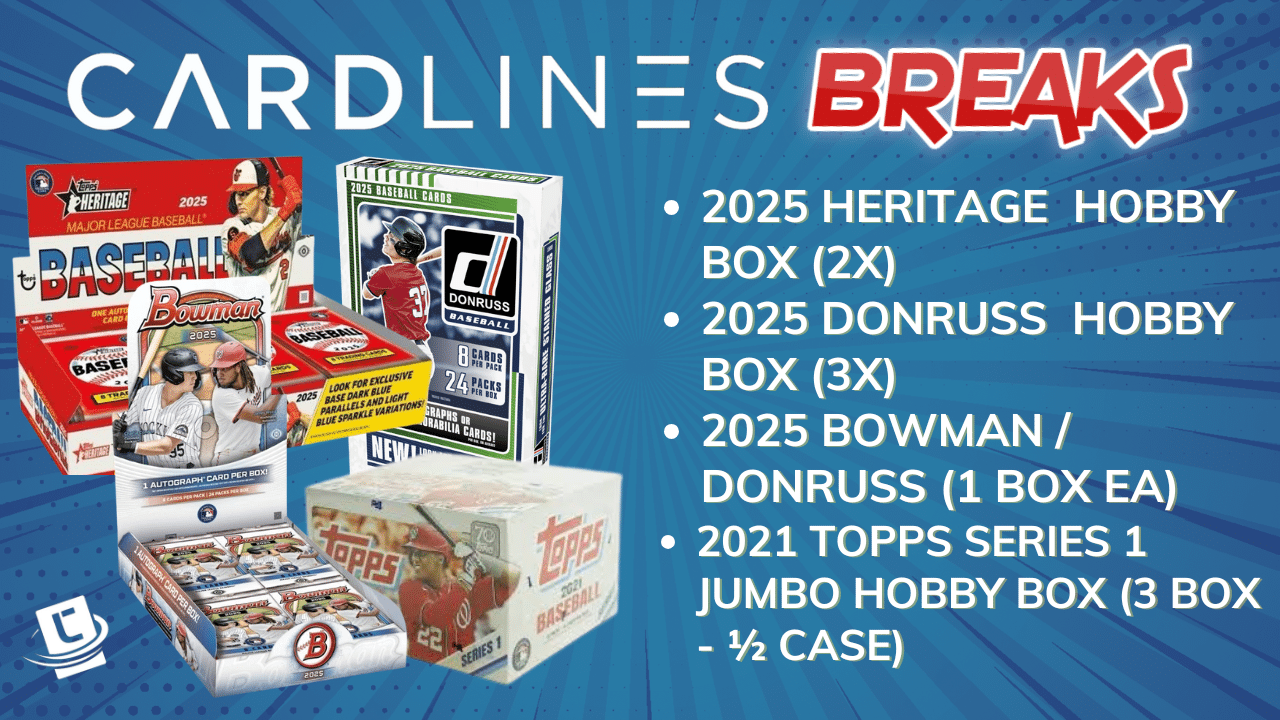

The Topps press release says the NFT’s will have the “artwork from the physical 2021 Topps Series 1 Baseball release, including iconic throwback card templates, anniversary sets and more, will be digitally enhanced and creatively reimagined as officially licensed Topps MLB NFT collectibles.”

What that means is that, in a move that can be seen as either dull or reassuring, the initial drop only features packs from the flagship Topps 2021 Series 1. The packs come in two tiers: standard and premium packs.

Here are the odds and specs for the Standard and Premium Packs from Topps NFT on release day:

| Type of Cards/ Type of Pack | Number of Cards | Common Cards | Uncommon Cards | Rare Cards | Super Rare Cards | Epic Cards | Epic Exclusive Cards (limited to 76) | Legendary Exclusive Cards (limited to 1) |

| Standard Pack ($5) | 6 | 78.11% | 16.67% | 4.17% | 0.83% | 0.22% | 0% | 0% |

| Premium Pack ($100) | 45 | 59.40% | 22.22% | 11.11% | 2.22% | 0.56% | 4.44% | 0.04% |

The design of the NFT’s will take advantage of its digital layout but will look very familiar.

Topps is working in partnership with Worldwide Asset eXchange (WAX), one of the world’s leading NFT marketplaces. A relative veteran in the emerging world of NFT’s, WAX and Topps have already launched the Garbage Pail Kids NFT’s together and developed a strong working rapport.

To start collecting Topps’ MLB NFT, you will have to sign up for a WAX wallet. To use it, you will have to buy into their WAXP cryptocurrency. You can do that by using your credit card, linking your bank account, or converting Bitcoin.

The WAX wallet is pretty user-friendly, even if you have never used crypto before. However, I find it a bit buggy and requiring some reloads and the like to navigate.

To buy into the Topps NFT, you will need a Wax wallet.

If you are looking to get into the MLB NFT’s on the ground floor, you will have to wait until the day of the release. While Topps made 10,000 free packs available for the first to sign up pre-release, those packs have run out. Therefore, you will have to wait patiently until the release. Luckily, their model seems to be more straightforward than Top Shot. You won’t have to wait for drops, but rather will be able to buy packs whenever you want.

While Topps is the veteran powerhouse in the American sports card industry, it has been losing ground to Italian card giant Panini in recent years. It hopes to use the IPO and its high-profile plunge into the NFT market as leverage to regain its premier position.

Topps hopes that their new product rides on the NFT craze waves and ends up rivaling NBA Top Shot for popularity. The move is part of the companies initiative to raise excitement around the recently announced Topps stock initial public offering (IPO) in partnership with Mudrick Capital.

In its public announcement on the Topps IPO, the founder and Chief Investment Officer of Mudrick Capital, Jason Mudrick, noted that the company “is well situated with a universally recognized brand to capitalize on the fast-emerging market for collectible NFTs. We are excited to partner with this exceptional organization to help write the next chapter in the long history of its truly iconic brand.”

That suits the vision of Former Disney CEO Michael Eisner, whose company Tornate Co. purchased Topps in 2007. He has reportedly long been pushing to move Topps into a more digital model, long before NFT’s came on the sports collectibles scene.

Until now, Topps has not invested much in digital collectibles. Therefore, the returns on their existing products like Topps Bunt make up a paltry 6% of its revenue.

However, investors are putting a considerable amount of money into the IPO. $571 million, to be precise. And their expectations for profit depend greatly on the success Topps has in the NFT market.

Will it succeed? There are some positive indications so far. Topps’ MLB NFT offered free packs to the first 10,000 to sign up and sold out immediately. And NFT’s are truly mainstream now. Even my 71-year-old father recently called me and asked if he should invest in them.

The Topps IPO and NFT launch are part of an attempt to update its image.

There is no getting around it; baseball does not have the NBA’s market reach and popularity. The two have comparable fan bases in the US, with 9% of American fans saying that baseball is their favorite sport and 11% naming the NBA (the NFL obliterates both, by the way).

However, globally there is simply no competition. Basketball and cricket compete for the #2 spot behind soccer. Baseball has about one-fifth of the fan base that basketball has. So, Top Shot has a much bigger potential market.

Another problem is that let’s face it; baseball has an older fan base (and I include myself in that). One survey puts the average age of viewers watching MLB broadcasts at 57. That is why half the ads during baseball games are for erectile dysfunction drugs and reverse mortgages. Not that any of us baseball fans need either of those things.

Older people are going to be less likely to change their collecting habits fundamentally. Meanwhile, the average NBA fan is 37 years old and far more adaptable. Indeed, young collectors may bypass traditional cards altogether in favor of NFT’s.

Finally, it looks to me like the Topps’ MLB NFT may suffer from its lack of imagination. It will basically be a digital release of the 2021 Series one. That is a product that most of us baseball collectors are already kind of sick of.

When Topps 2021 was released, many collectors complained that the design was unattractive and too reminiscent of the 2019 Donruss baseball series. Therefore, it may not enjoy the novelty and excitement value of the initial Top Shot release.

Will the Topps NFT overcome the limited global reach of baseball?

A lot of people have been burned by Top Shot. On April 11th, the overall value of Top Shot transactions was around $2.5 million. That may sound like a healthy market (and it is), but it is way down from around $34 million daily at its peak in late February.

Investors have realized that it is not as simple as grabbing any NFT and getting rich. A sense of general Top Shot fatigue has hit just as Topps’ MLB NFT is dropping, which is not good news for the release.

Obviously, many MLB collectors are not particularly interested in the NBA, but there is a lot of crossover. While many of the fans who are already invested in Top Shot will continue to do so, they may be hesitant to embrace a new platform for a less popular sport.

NFT’s are not a fad. They are here to stay. However, that does not mean that every NFT product will succeed. Remember the dot.com bubble? I certainly don’t because I am way too young and cool.

But what happened there is investors thought anything online is bound to succeed. While they were right that internet commerce had a massive future, they still lost a ton of money on specific companies that did not offer a strong enough product. For every Amazon, there are several pets.com.

We are not saying that Topps’ MLB NFT is going to fail. But the product does not, at first glance, seem particularly distinctive or appealing. However, Topps has massive money behind it and will have time to adjust its offerings and retool. So, we aren’t saying don’t invest: but be careful.

0:58

0:58

The best small town card shop? 👀

Sports Card Scavenger Hunt! (5,000 Subscriber Special!)

I hit a SWEET auto from the #1 overall pick at PCB hobby

The Ultimate 2024 Football Card Brand Tier List (Panini vs. Topps and more!)

2025 Topps All Star Game Mega Box Product Review

Ripping the new Topps All Star Game mega box.

Is this new sports card store the BEST VALUE around?

I Tested eBay Auction Promotions So You Don’t Have To!

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

Keep up on breaking Sports Card News, our latest articles, product specials and exclusive content with expert analysis of hobby trends.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

Top 5 Sports Card Athletes to invest in RIGHT NOW (big ROI potential!)

Cardlines 11 hours ago