Some of us just buy cards and complete sets like old-school collectors. But to an increasingly large sector of the hobby, our collectibles make up some (or even all) of our income.

So, as much fun as it may be to collect, it’s also technically a business. And that means that Uncle Sam wants to get his grubby…I mean, the income may be taxable. Furthermore, the IRS is hiring more agents and paying more attention to the hobby because it is becoming a major cash cow.

So, how should you treat your card and collectibles profits on your 2022 taxes? Our 2022 taxes and sports card update have you covered.

2022 wasn’t the best year for sports cards. As a result, many of us who buy and sell have taken significant losses. It’s not that the market is tanking. But the air has come out of the COVID-19 boom’s bubble, leaving many people looking at their investments and inventory and wondering: What have I done?

But don’t worry. We will all adjust and have the tax advice you need to handle this challenging period. Follow it, and you may be turning a profit again very soon.

Now, remember, we aren’t accountants. So follow up and do your research. After all, you don’t want to be audited because you forget to file profits on your O.G. Anunoby Prizm, right? But this article will help nonetheless. These are some tried and true pointers and strategies to navigate your 2022 tax returns and live to tell the tale.

The value of our card collections fluctuates quite a bit over the years. Some of us have apps that track the value of our cards, and we keep a close eye on their overall worth. That is all good, but none of that interests the IRS.

But those changes on paper are not taxable events. Like when our stocks shoot up and down, that is not a taxable change. But when we sell our collectibles and generate income, that is taxable.

Much of the activity in the sports card world goes unreported. Especially when it involves smaller sellers. But every sale has to be reported by law. If you are not reporting your sales, you are breaking Federal Law.

Of course, IRS doesn’t have the interest or manpower to go after every small violation. But if you wish to follow the law and avoid headaches, report all of your sports card and collectible sales. The higher the volume you deal in, the bigger the risk you incur if you don’t.

But you don’t owe any taxes unless you make a profit beyond your investment. So don’t worry; we will clear all of that up below.

There are no significant changes to how you file your sports card-related expenses for the 2022 tax year. However, some substantive alterations in 2021 still apply this year and are worth remembering.

Starting in 2021, the IRS began mailing 1099-K forms to people selling cards online. This form is for Payment Card and Third-Party Network Transactions. So, if you are receiving credit card payments for eBay sales, you will get one. Check out our complete guide on how to fill it and what it means.

It didn’t really change much legally. You were always supposed to fill that, but many people (who are we kidding, most people) did not. So now the IRS was kind of forcing you to. Make sure to fill out the form accurately, and you will be fine.

If this is your first rodeo, it may surprise you that the IRS can be particularly heavy-handed regarding collectibles. As far as the Feds are concerned, these are part of a classification they refer to as “alternative investments.” This category includes all assets that fall outside the most common investment categories of stocks, bonds, and currencies.

The IRS defines a collectible as “any tangible personal property that the IRS determines is a collectible.” That is very helpful, guys. They give the following examples:

Although they do not give our favorite hobby the respect it so clearly deserves, there is no doubt that they also mean sports cards. As any accountant will tell you, the idea behind taxing collectibles is that the items have an intrinsic value inherent to them by public interest, cultural notability, and rarity.

Therefore, whatever you might consider a collectible falls within this category. So, it includes your cards, jerseys, autographed memorabilia, and the like.

If you sell any alternative asset at a profit, you can be liable to pay a capital gains tax on the profit. Treating your cards as an investment involves filing them as a Schedule D. The relevant form (form 1040) is used for “the sale or exchange of a capital asset not reported on another form or schedule.

At its highest, that rate can reach 28% of the profit after one full year of ownership. So why does the amount of time you own the card matter? It’s simple:

You may be wondering why the rates on collectibles are so high? That is because our federal government, in its infinite wisdom, believes this is not an investment that drives the economy. Instead, they prefer to incentivize things like hi-tech, employee training, and building weapons. So, collectibles tend to be charged a higher capital gains tax.

The IRS treats collectibles as an investment. But if they are a primary source of income, you may be better off treating the buying and selling of the cards as a business. People who have worked freelance, have a lucrative side hustle or have a small business often file a Schedule C with the IRS.

How do you know if this applies to you? Here are the two circumstances wherein people usually file Schedule C’s:

This does not apply if you sell the occasional card. Even if the items you do sell are of exceptionally high value, instead, this is the form you use when treating your cards as inventory.

Filling out taxes for a business is a complex process and is above our pay grade here at Cardlines. But as you prepare to do so, this is what you will need to keep track of and gather:

One of card business operators’ main mistakes is deducting their inventory expenses before selling them off. That is not how any of this works, people. Sure, inventory is a business expense. But you can only deduct it once it’s sold. Otherwise, anyone could just stockpile goods for their use and deduct them. So, don’t get on the wrong side of the IRS.

The great thing about filing Schedule C, is that you pay taxes in accordance with the tax bracket you are in. So, you end up paying lower rates than you would on selling collectibles ad-hoc. But if you are not a business, you will have to pay a percentage of each sale’s profit. So, since that tax can reach a flat 28%, you are better off as a Schedule C if the IRS allows you to do so.

If you are collecting cards as a secondary form of income or just for fun, you will be incentivized to have as little income as possible at the end of the year. Why? So, you aren’t taxed on it. Instead, you will want to invest in more cards and memorabilia. We feel you!

But you have to be careful doing that. If you lose money too many years in a row, the IRS may remove your Schedule C status and classify your cards as collectibles.

Generally speaking, they tend to do this when you show a loss for more years than you have gained. So, if you are in the red three years out of five, you could be reclassified. Therefore, the best strategy you can pursue is making a small yearly profit. A few hundred dollars should suffice.

Ok, so let’s say you are not selling cards as a business. But you made money on a card; that’s awesome! You will need to pay the IRS a certain profit percentage. The good news is that you are not taxed for the entire value of the sale. They are only coming for your profits. But how do you figure out the exact amount that you owe?

Cost basis is one of the basic calculations investors make on their assets to figure out the capital gains tax they might owe on a stock or bond. They do so by calculating how much they invested in the asset, including fees and commissions paid to obtain it, and then calculating how much profit they made during the year on that investment.

The process is very similar when calculating the profit you made on cards. See, the cost basis for a collectible is the total amount of money you paid to obtain it. To figure that, add together all of the following:

That is pretty easy to calculate because the receipt you receive from the seller, whether through eBay or an auction house, should include all the fees. When in doubt, look at what was deducted from your credit card!

So, let’s take a standard sports card example. You bought a card on eBay, graded it, put it on Goldin Auctions, and sold it for a profit. What do you count as your cost basis?

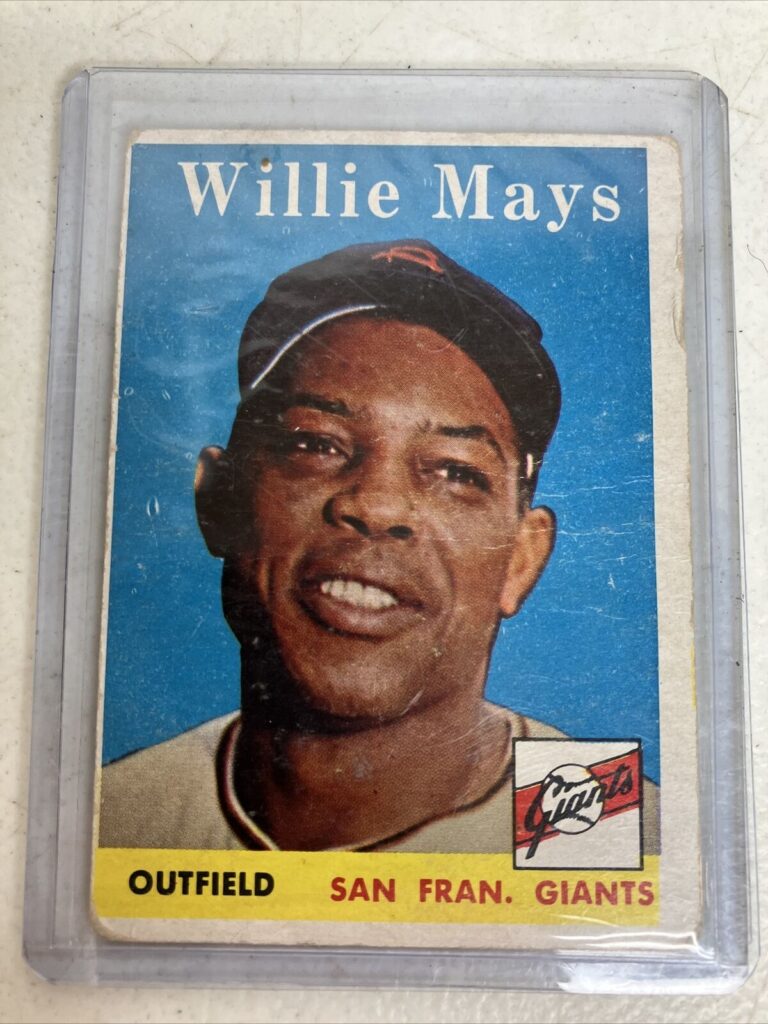

Let’s say your card, a 1958 Willie Mays Topps card, cost you $140 on eBay raw. It’s a handsome specimen, and you think it will grade well. Unfortunately, you paid an extra $15 in fees and shipping on that baby. But you don’t want to resell it raw; what is the point?

You are a PSA member; you can get it graded for $19. But you also pay $12 shipping for the grading. After waiting awhile, your submission pops, and your Willie Mays card got a PSA 8! You manage to sell it for $500 on Goldin Auctions. It costs you $25 to list it, and Goldin takes a 10% commission on the sale.

Let’s do the calculation for you:

That is all well and good for those of us who buy and sell cards regularly. But some of us inherit collectibles from friends or relatives. Indeed, some people find themselves in ownership of an estate with valuable collectibles. As a result, you will have to calculate your cost basis differently without proof of purchase.

In these cases, the basis for calculation is the Fair Market Value. This mechanism is most commonly used in real estate deals. That is one of the most common forms of inheritance, after all.

And if you have had the misfortune of going through a divorce, you may have had to use this concept to divide the assets. But it is also used for the inheritance of collectibles in an estate.

When an item has not been bought on the open market in recent years, it is up to the taxpayer to ascertain the fair price the item would sell for under relevant conditions. That is worth noting what these circumstances are:

You can see the idea here. The IRS wants the market conditions for an utterly fair sale, with no external pressures affecting the item’s price. That means that the listed price for an item, which can be influenced by some (or all) of the factors listed, may be quite different from the Fair Market Value.

The concept of a Fair Market Value is kind of vague. But luckily, the IRS allows you a few different options to determine it.

Once you have assessed the Fair Market Value, treat it the same as the initial buying price for your cost basis. Then, add any improvement costs you incurred before resale, such as grading, listing, etc.

If you have had a bad year, you may be tempted to avoid filing a Schedule C and just get out of dodge. But that is not always a good idea. For example, if you are still holding on to a significant amount of inventory, you may want to continue to file as a business until you can offload it for a fair price. Because if you don’t file a Schedule C, the cards will be treated as Schedule D and taxed at a higher rate.

You will likely want to take it slow in selling off the remaining inventory. Because remember, you pay lower tax rates on long-term investments (ones that you hold for over a year) than on cards you turn over within 12 months.

We know that you didn’t get into the hobby of filing taxes. And it really sucks that when you finally make a little profit, it gets slashed by the IRS. But filing taxes is the law, and we all love having roads and stuff. So, make sure to follow the rules closely.

But that doesn’t mean you need to be a sucker. Tax law in America has many loopholes, giving you options to deduct expenses and find the schedule best suited for your needs. So, don’t pay more than you have to. Instead, use every rule in your favor. Be smart, and you will be turning a profit again in no time.

I deep-dove on Fanatics Collect so you don't have to (but should you?)

Panini is launching a WNBA Product at $30,000!?

Topps Chrome 2024-25 Basketball: Honest Review and Notes

Did you know this SECRET about PSA slabs? #sportscard #tcg

5 EASY tips to make more money on eBay sports cards.

I opened a sports card mystery box and found something AWESOME inside

The SAD story of Collectable. What went wrong? (The Downfall Fractional Sports Card Investing)

what was Panini doing? 🙄

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

Keep up on breaking Sports Card News, our latest articles, product specials and exclusive content with expert analysis of hobby trends.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

I Tested eBay Auction Promotions So You Don’t Have To!

Cardlines June 30, 2025 7:01 pm