There are new 1099-K tax reporting laws coming into effect for 2022. If you sell sports cards, you must report your income to the IRS. If you have never filed before, you probably have many questions on sports card sales and new 1099-K laws. Hopefully, we have the answers for you.

Even if you are a veteran seller, changes are coming down the line. They do not affect the 2021 tax year. However, they apply to 2022, so any transaction you make now falls under the new rules.

Tax season is almost upon us. Here at Cardlines, we are ready to deduct our brand-new private jets and Lamborghinis. But we will take time off to help you navigate the new rules.

As a caveat, we are not professional accountants at Cardlines. We are just providing you with general guidelines. Make sure to consult a professional when filing your taxes because this is serious business. Remember, the government nailed Al Capone on tax evasion. No one wants to go to Alcatraz because they didn’t report selling a PSA 9 Bo Bichette.

According to the law in the United States, you must report all income to the Internal Revenue Service. Therefore, you must self-report all income to the government or face possible consequences for failing to do so.

Al Capone ended up in Alcatraz because of tax problems.

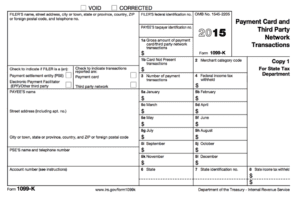

One of the primary tax forms is Form 1099-K, Payment Card, and Third-Party Network Transactions. As the name implies, the Form pertains to sellers using credit cards for payment on third-party online platforms.

The 1099-K was designed to increase the accountability of the growing online sector of the economy. The Form is intended for businesses with online components and accepts credit card payments via the internet. You may receive these from third parties you do business through. For example, credit card companies or eBay may send you a form.

You must fill these forms accurately. Reporting inaccurately may result in an audit or even paying too much tax to the IRS. Lord knows we can’t have that.

You will likely receive one if you have received regular credit card payments for online merchandise. In most cases, they are mailed out and received by Jan 31.

Traditionally, these forms were mailed out to individuals with a large volume of transactions.

That remains the standard for the 2021 tax year. However, the standards will change for the 2022 tax year. So if you made over $600, you would receive the forms by Jan 31, 2023.

So, the short answer is unless you run a significant and severe card business, you will not receive a 1099-K Form for the 2021 tax year. But even modest sellers will receive one for the 2022 tax year.

Third-party platforms must fill a 1099-K Form which includes the gross total of transactions for each month in the applicable tax year. The Form will also have the annual total in a separate box. It should also include the payees’ taxpayer identification number.

Here is the 1099-K Form in all its glory (picture taken from Wikipedia).

In 2021 the U.S. Congress passed the American Rescue Plan Act of 2021, often known as the COVID-19 Stimulus Package. The plan included several measures to alleviate the pain of American citizens and business owners hit by the pandemic.

To pass the bill, the lawmakers searched for sources of revenue to offset costs. One method lawmakers came up with was to drastically reduce the level at which third-party companies had to report workers using their platform. Congress projected that this would raise $8.4 billion over the next ten years.

The money would come from people making a few bucks on Door Dash and eBay. Among those people are card sellers like you. Technically, this does not change the status of your income. After all, you are always supposed to self-report income to the IRS. However, in practice, this will make many people who would have either intentionally or unintentionally neglected to report their earnings and pay taxes on their profits.

There has been a good amount of backlash to the new standards. In theory, the law change does not alter much since there has always been an obligation to report. In practice, many people in the so-called “gig economy” do not report their small earnings.

Neither the platforms nor the sellers are happy with the change. The rules caught lobbyists for platforms like eBay and Door Dash unaware. These companies and their representatives on Capitol Hill have vowed to try to reverse the changes. After all, this change may scare people off their platforms, which is bad for business.

The eBay website exclaims:

“While eBay is unable to give tax advice to our sellers, we want to help make dealing with taxes as easy as possible. Our goal is to help you with these new requirements. We are lobbying Congress on your behalf to raise the $600 threshold. It’s a threshold that ignores the fact that income from selling used goods, usually sold at a price below the original price, is rarely taxable.”

eBay and other platforms have strong lobbyists on Capitol Hill.

The law applies to all third-party settlement organizations or TPSOs. So your next question, predictably, is what is a TPSO. A TPSO is an ongoing financial arrangement with the following characteristics:

Any third-party platform which sells cards fits this description. That would include:

You do not attach the Form to your tax returns in most cases. Instead, you use the figures and enter them into your tax return as income from a small business. Then maintain the 1099-K Form for your records.

The exception is if you receive your Form with tax already withheld. In that case, mail it in with your filed return.

Keep in mind that unless you meet the old criteria ($20,000 plus over 200 annual transactions), you will not receive a form in January 2022. You will only receive one based on the new criteria in January 2023.

If you are supposed to receive one and haven’t, it is your responsibility to ensure it arrives. The IRS suggests you do the following: “If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the Form by Feb 15, call the IRS for help at 1-800- 829-1040.”

If you receive your Form after filing your taxes, you still must report the relevant income. In that case, report the figures by filing Form 1040X, “Amended U.S. Individual Income Tax Return.”

In the tax year 2021, eBay will continue to send out 1099-K forms to individuals with a high volume of transactions. However, 2022 will see the company change its policy per the new tax laws.

Here is what eBay has to say about implementing the new rule:

If you ship a lot of boxes on eBay, you may receive a 1099-K form in the mail.

For 2021, Venmo will continue to send 1099-K Forms according to the old criteria. Therefore, the changes will only take place in 2022.

Keep in mind that Venmo is only obligated to report individuals who receive payment through the sale of goods and services. So, you can get past this by making sales through friends and family sales. However, we do not recommend this. Your transactions will not be guaranteed, and technically it counts as tax fraud.

PayPal is the parent company of Venmo. Therefore, it has similar rules.

Like all companies, it will not be implementing the new rules for the 2021 tax year. Like Venmo, PayPal reports goods and services sales and does not address friends and family transactions. Still, we recommend conducting all business transactions through the proper channels.

Whether or not you need to pay taxes for the income is a different story. According to U.S. law, you do not have to pay taxes on a hobby. However, your definition of a hobby and that of our friendly Uncle Sam may differ substantially.

The main criteria differentiating for-profit activity from our hobby-oriented activity is the level of sustained economic gain. If you have earned a profit on card sales for three out of the five most recent years, you are running a business for tax purposes.

Even if your card sales operation doesn’t meet the criteria, it still may be considered for profit by the IRS.

I don’t want to get you in trouble with the taxman. So, I will quote the IRS guidelines in full:

In distinguishing between a hobby or business activity, consider all facts and circumstances concerning the activity. A hobby activity is an activity not done for profit. This includes activities done mainly for sport, recreation, or pleasure. No one factor alone is decisive. However, you must generally consider these factors in determining whether an activity is a business engaged in making a profit:

As you can see, the criteria can be confusing and vague. However, I can simplify it somewhat. If you are making money consistently by selling cards, the chances are that you are running a for-profit business from the perspective of the IRS.

Are cards your business or hobby?

Remember, no matter what, you have to report the income. If you do qualify as a hobby from the perspective of the IRS, reporting the income is quite simple:

There is good and bad news if you do qualify as a hobby. Do you want the bad news first? Sure. You cannot deduct expenses for a home office for a hobby. Until 2018, this was an option. However, tax reform removed the possibility of hobby expense deduction. That deduction (which can be worth anywhere up to $1,500) is only relevant to income-generating business activities.

I promised some good news. You do not have to pay income tax such as the unemployment tax for your hobby. If you are running a hobby, you will not be required to pay self-employment taxes.

If you have been consistently profiting off of your card business, you will need to pay income tax on it. That means complying with a completely separate set of rules than those intended for hobbyists.

Card business owners must declare their income on Schedule C. You will then be required to pay both income tax and self-employment tax.

Here is how to do that:

The IRS defines a business expense as one with the two following characteristics:

So, in both cases, you can’t deduct your hot tub. Sorry, everyone.

The new tax rules do not fundamentally change your obligations as a sports card seller. You always were required to report profits. However, the rules do mean that there is more scrutiny on small sellers. In addition, the U.S. government depends on you to fill a budgetary hole opened by the Covid stimulus package. Therefore, make sure that you follow the rules closely and by the letter.

There is a chance that the laws will be revoked. The prominent players in the “gig economy” have a strong lobby on Capitol Hill and want these changes repealed. But don’t count on a change. Instead, prepare for the new rules now, so you are not blindsided.

The SAD story of Collectable. What went wrong? (The Downfall Fractional Sports Card Investing)

what was Panini doing? 🙄

I compared sports card prices from the big sellers to save YOU money

Is GameStop buying PSA? (the truth!)

I ripped an entire case of Phoenix Football (BIG win or MASSIVE loss?)

Make an extra 30% PROFIT on eBay with this sports card hack

What's your biggest trading card regret? This is a safe space. 🤣

I used ChatGPT to invest in sports cards (and make this thumbnail lol)

BCW Thick Card Toploaders 197 Pt. 10 per pack

BCW Thick Card 59 Pt. Toploaders. 25 per pack

BCW 20 Pt. Toploaders. 25 per pack

BCW Standard Card Sleeves. 100 per pack

BCW Thick Card Sleeves. 100 per pack

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

I opened a sports card mystery box and found something AWESOME inside

Cardlines 9 hours ago