-

2021 Panini Prizm Baseball Cello Box

×

$69.991 × $69.99

2021 Panini Prizm Baseball Cello Box

×

$69.991 × $69.99

Do you want to invest in unopened wax? Cardlines is on a quest to bring you all the best insight into trends and strategies in sports card investing. In keeping with the goal, this article will discuss wax investing or investing in sealed boxes. A good wax investment strategy can lead to MAJOR payouts if done well. However, like everything else, there are also risks.

Wax investing is investing in factory-sealed boxes, sets, packs, and other sports card products. There’s no wax involved anymore, but the name has stuck in the popular imagination.

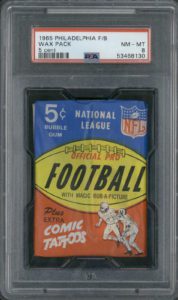

Sports card packs were once made of wax paper (look for graded wax packs on eBay).

Wax investing is a smart strategy for several reasons. We have compiled the major ones for your perusal.

The greatest single thing about wax investing is that it represents the entire draft class. Every standout rookie helps boost the value of the investment. For example, if you bought a Mitchell Trubisky rookie in 2017, it wouldn’t be worth much today. However, if you purchased a box in 2017 and held onto it, it would be worth a lot today because of Mahomes, McCaffrey, and the other great rookies in that class.

Closely related, sealed boxes diversify risk because all your eggs aren’t in one player’s basket. If you own a John Smith rookie card, his card will drop in value if he gets injured. The other rookies will help prop up the value of a box despite the unfortunate Injury.

I’ll let you in on the sad reality of boxes (this is top secret, shhh): 90% of the time, you’ll regret ripping. However, the hope of what you might find inside is usually more valuable than the actual content. Therefore, leaving the box sealed is probably the safest investment you can make.

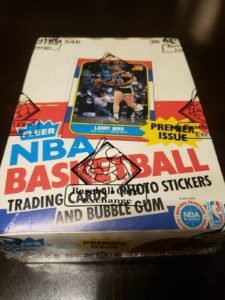

A 1986 Fleer box may not contain a Jordan rookie, but the price will still be sky high (look for Fleer Basketball 1986 wax on eBay).

There are some drawbacks of wax investing, too. Let’s give them a look.

There are a few draft classes that are just flat-out bad. For football, think of 2006: with Vince Young, Matt Leinart, and Reggie Bush as big-ticket rookies, that class was guaranteed to be awesome, right? Sadly, no. There’s not a card in that set that still demands big bucks. Instead, great years hit just around 2006. For example, 2005 Topps has Aaron Rodgers, and 2007 has Adrian Peterson, Calvin Johnson, and many more. Much like the 2006 football class, some years just fizzle out.

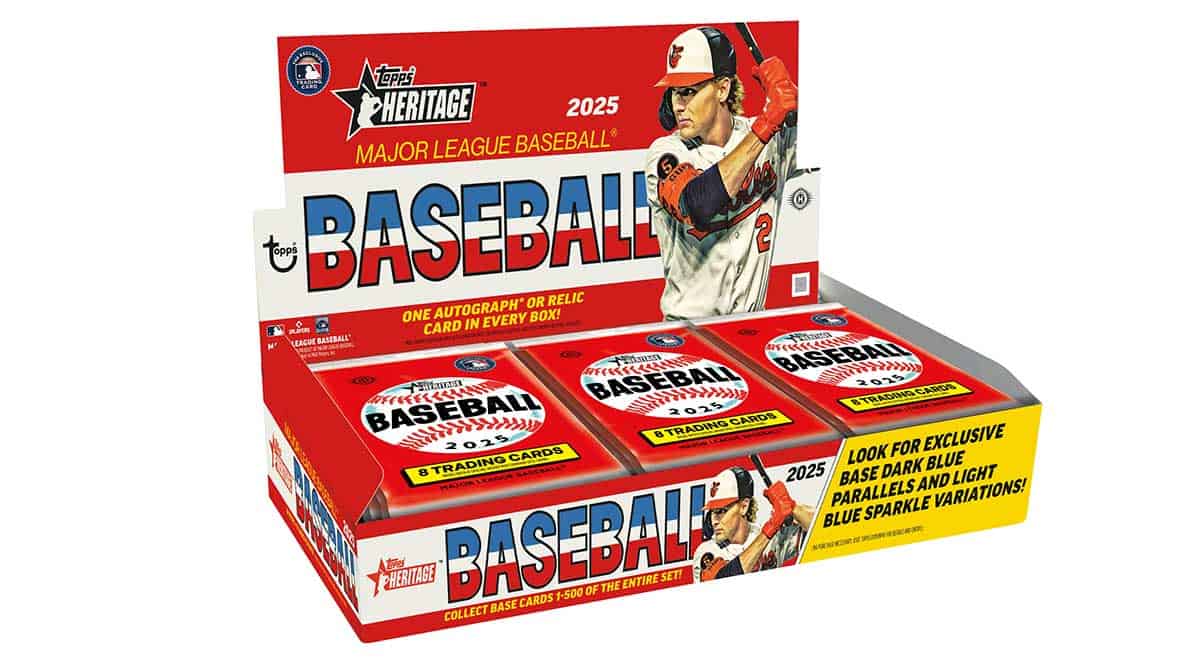

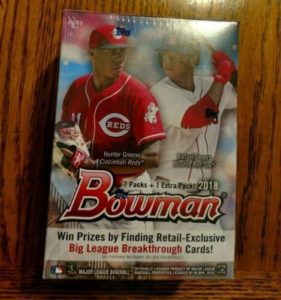

While some brands are shoe-ins to be popular for a long time, others come and go. For modern basketball and football, Prizm and Optic seem like the best options to sit on. For baseball, it’s a bit harder to tell. Bowman, Topps, and the chromium step-brothers are always good bets. Bottom line: there are so many brands that nobody knows which will remain popular and demand a good price, especially with the pending Fanatics merger.

Lastly, sitting on wax is just hard to do! Tell me you can walk past a sealed box, look at it every day, and not be at least slightly tempted to rip it and see what’s inside. If so, you’re a better man than I. I struggle with this every day. Pro-tip: whisper “ROI” under your breath every time you walk past your storage area.

Would you be able to resist opening this? (look for Bowman 2018 wax on eBay).

Here’s the list of the four different types of wax to invest in, along with the relevant risk and rewards.

What counts as vintage wax? Think the early 80s and older (you don’t want any from the 90s, trust me). Most of this is full of big-dollar cards, but there are a few duds mixed in depending on the year and sport. But, again, age and nostalgia help these sell, along with the eternally high demand for past-its-sale-date bubblegum.

Modern wax is full of rookies still actively playing, and its price has adjusted to the talent level of the draft class. Of course, that doesn’t mean the price is set. However, there is less volatility because collectors have an idea of what’s inside.

Release Day Wax is buying modern cards at release day prices. This move is probably the riskiest. After all, you are banking on the rookie class being good and the brand maintaining popularity. So, it’s a higher-risk, higher reward. Sometimes release day prices double overnight. But they have been known to crash just as quickly.

Buying retail wax is a significant short-term flip if you are fortunate enough to find some in the wild. However, try to only buy this in the wild at around retail price. Unless the Walmart and Target near you impose a limit on cards, it will take a tent and a lawn chair to find this stuff.

Investing in wax can be profitable. You can avoid many losses by following these simple tips.

Big red flag on this, and that probably won’t be a popular opinion. If you want to get a quick flip in, that’s one thing. However, buying COVID-19 boom-era wax to hold is unlikely to pay off. I think ten years from now, we will zoom out and see the market was flooded with low-quality retail boxes at this time.

Retail from 2020-2021 may be more of a rip than a hold (look for Optic Basketball 2021 boxes on eBay).

There are enough pack searchers out there that ruin the idea of buying packs for many people. In other words, sealed packs are worth less than they should be because they’re easier to manipulate and find packs with valuable cards. For example, here’s an article we wrote about Donruss Fat packs from 2020-21 basketball and why they’re a honeypot for pack searchers.

Just because a box is cheap doesn’t mean it’s poised to be a great long-term hold. There are so many football brands out there that I’d recommend investing in smaller quantities of the good brands. Avoid buying a bulk amount of brands nobody will want in 10 years (like Prestige).

Now that we’ve discussed the four different types of player investments, here’s a sample from each category type.

Talk about a loaded rookie class. And many of them are still developing. Headlined by Luka Doncic, Trae Young, DeAndre Ayton, Michael Porter Jr., Shai Gilgeous Alexander, and others, this very well might be the most talented draft class ever to get a Prizm set. If you can find these boxes sealed, the value will only climb.

Easily the least expensive product on the list, 2018 Topps Chrome could yield a strong return. With rookies of Ohtani (and many others), the product will continue to rise if the young two-way star continues to dominate consistently.

Mahomes and McCaffrey. That alone should be enough to understand just why these boxes are so pricey, but both of them are putting together cases for immortality. So it is more than likely that their rookie cards will increase in value.

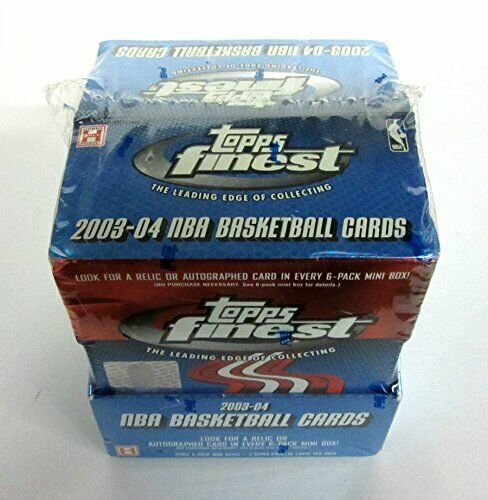

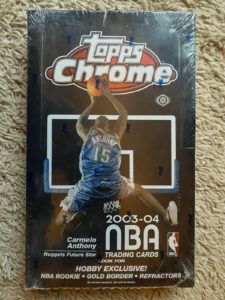

This is a good box to have (look for 2003-2004 Topps basketball wax on eBay).

Finally, if you can find any sealed Topps or Topps Chrome basketball from LeBron’s rookie year, it’s as close to a blue-chip investment as you might find in sports cards. Every year this product ages, the value will increase. LeBron’s career is already one for the history books.

Whether you’re looking to lock up sure-fire returns or take a chance that could lead to a massive payout, wax investing is a great strategy for you. So who are your favorite players for investment? Let us know on Twitter @Card_lines.

What PSA's price increase means for grading + Bowman 2025 Baseball and more

32 Spot Random Team 2024 NFL Mosaic Mega 8 Box Break

32 Spot Random Team 2024 NFL Mosaic Blaster 10 Box Break.

Sealed Blaster Box of 2022 Topps MLB Baseball Update Series.

Sealed box of 2019 Topps MLB Baseball Series 2 Hobby Box. 1 autograph or relic card guaranteed. Great rookie class.

Sealed Box of 2021 Panini Prizm Baseball Cello. 12 packs per box, 18 cards per pack.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.