With Fanatics’ increasing dominance in the card business and its direct-to-consumer selling approach that bypasses distributors, the sports card distribution industry is facing a period of uncertainty.

The recent move to restrict purchases by those with a Topps Direct account is a clear indication of this direction.

This industry-altering story raises significant concerns about the future of distributors.

We were contacted by a card dealer with a Topps Direct account and an account with one of the significant retail distributors in the hobby.

This individual has done business through both accounts for quite some time. However, in his last attempt to purchase through the retail distributor, he was told he could not do so because he had a Topps Direct wholesale account.

Fanatics is now trying to limit people with an account from buying Topps products from elsewhere.

This development not only poses a significant threat to the hobby but also potentially puts distributors in a precarious position. If those selling cards are forced to choose between partnering with retail distributors and Topps, the latter is likely to be the preferred option.

This could have far-reaching implications, raising serious concerns about the future of their business.

Fanatics made a significant move by removing GTS, the leading card distributor in the United States until 2022, from the equation. This action was a clear manifestation of Fanatics’ strategy to control the supply chain.

They released a statement at the time, “Over the past twelve months, Topps has prioritized working directly with hobby shops and a broad array of customers to ensure they have better access to the latest and best products and promotions. As part of that effort and to better serve the hobby and its growth, we will strategically adjust our product allocation and distribution channels to create the best experience for all collectors.”

At the time of the GTS deal, Josh Luber said that Fanatics’ ultimate goal is to influence the supply chain: “We all win if we grow the hobby and bring in more customers and figure it out. And very much related to that, if that is goal 1A, 1B is how do we all work better together, because any people coming into the hobby, we have to be able to get through the entire value chain, from education to selling a card and everything in between, buying packs and opening them and breaking and grading and selling and everything in between, which is not to say that we will do all that. Still, we must figure out how to work with all those people in that space because customers need that entire value chain.”

He told card shop owners that he viewed them as partners: “Even if we wanted to move all the products [ourselves], we couldn’t do that if we wanted to, and, by the way, they are part of the customer experience. With trading cards, you need that asset, that hobby shop owner, the dealer, that interaction.”

But notably, he did not say the same about distributors.

The Wall Street Journal reported in 2021: “People familiar with Fanatics Trading Cards say the new venture will angle to become the one-stop shop for all things in the trading card industry—including primary sales, secondary-marketplace deals, grading of cards and even storage.”

In 2022, Fanatics announced that it would create a system of drops that would be directly accessible to consumers. There is nothing too revolutionary about this.

Panini has been doing things similarly for quite some time. However, Fanatics have the money and the ambition to make direct drops a much more significant part of the market than Panini ever could.

Michael Rubin, the owner of Fanatics, explained back in 2021 what the vision was behind this: “This is really about a completely different vision for where the trading card industry should go. I think if you are going to think about the collector experience, it is pretty brutal today. You’ve got to buy primary cards with so many people kind of in the middle of it that you buy primary cards and sell secondary cards somewhere else. You get your cards graded by another party; you must store them with someone else. … This is about our vision to create an incredible collector’s experience, bringing all the pieces together.” There is no place for distributors in this vision.

In June 2023, Topps required brick-and-mortar card shops that wanted to continue selling their products to sign on to 17 terms and conditions. Some of them were pretty standard.

However, certain elements will reshape the relationship between card stores and Topps. They seem to have been crafted to facilitate direct sales between Topps and consumers.

They now use that agreement to leverage stores into buying only from them.

Several clauses in these contracts limited the ability of sports card stores to work with other actors. It appears that this is the clause on which the limitation to the distributors is based:

“Products purchased through an account are for distribution through the store(s) identified in the account information attached only. For clarity, products are for resale directly to consumers in physical retail, brick-and-mortar environments only, in their original, unopened form -i.e., no business-to-business sales unless otherwise agreed by Topps in writing. Retail shall not use its accounts for personal shopping, and products shall not be used for repacks unless authorized in writing in advance.”

However, others justified a good deal of interference:

“Retailers may use products for in-store breaks, provided that breaking slots may not be sold or solicited online or to anyone not present in the Retailer’s store during the break. Further, the direct buying program is for established brick-and-mortar stores with four walls and is not contained within a larger store or environment. Online-only retailers (including retailers with a majority sales volume derived from online sales) are not eligible for this direct buying program.”

So you know Fanatics means business; they added to this clause the warning: “Any account found noncompliant with the preceding may be terminated immediately.”

And with extreme prejudice, no doubt.” That is undoubtedly why many distributors and stores fear violating Topps’ terms and conditions.

As you can imagine, dealers affected by the news don’t feel that great about it.

One owner of a relevant company in the hobby told us, on the condition of anonymity: “’This has an immediate impact on my business. But I’m worried about what it will mean when Topps licensed basketball and football are out. Will I be able to get any? What will the price be? Will we all be begging for Panini back?”

Another dealer was happier about the situation, saying, “I hope those guys get cut; they’ll know how I feel!”

We can see from these reactions that the distributors are controversial in the hobby. They are known for playing favorites and jacking up prices. However, there is a lot of fear of the unknown and concern that a future with no other actors but fanatics might turn out worse.

Sports card distributors are not among the most popular actors in the hobby, to put it mildly. Even when sports card companies try to offer reasonably priced products, they often raise the cost to consumers.

That is doubly true when it comes to viral releases. But that is just natural. They are actors trying to get a cut.

The problem is that if Topps and Fanatics are the only players in town (which appears to be their goal), they have outsized power to raise prices and lower the level of service accordingly.

They will also lower the number of choices customers and distributors have and further keep any other actors outside of the hobby.

In their drive for a monopoly in the hobby, Fanatics have muscled out all sorts of actors. The most notable one has been Panini, with whom they have had a series of spectacular and high-profile lawsuits.

But that is not the only front they have been trying to centralize their control. Since 2021, Fanatics has taken measures to limit the powers of the distributors, aiming to remove their share of the pie.

They have done so, among other ways, by tightening their grip on local card stores through contracts that make it difficult for them to even deal with distributors.

I deep-dove on Fanatics Collect so you don't have to (but should you?)

Panini is launching a WNBA Product at $30,000!?

Topps Chrome 2024-25 Basketball: Honest Review and Notes

Did you know this SECRET about PSA slabs? #sportscard #tcg

5 EASY tips to make more money on eBay sports cards.

I opened a sports card mystery box and found something AWESOME inside

The SAD story of Collectable. What went wrong? (The Downfall Fractional Sports Card Investing)

what was Panini doing? 🙄

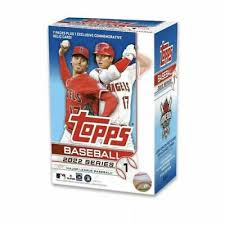

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

Keep up on breaking Sports Card News, our latest articles, product specials and exclusive content with expert analysis of hobby trends.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

I Tested eBay Auction Promotions So You Don’t Have To!

Cardlines June 30, 2025 7:01 pm