PSA has been the true winner of the bizarre year that was 2021. Here at Cardlines, we predict that PSA will monopolize grading completely within a few years.

There have been several important trends in the hobby this year. Perhaps the most important relate to the monopolization of services by strong actors, at the expense of the rest. Of course, the most obvious story concerns the emergence of Fanatics as the sports card manufacturer of the future. But PSA has made, as Cardi B would put it, money moves that will alter the landscape of the hobby.

Here is an overview of their strategy and where PSA is going.

Collectors Universe was itself acquired by a group including Nat Turner and New York Mets owner Steve Cohen for $853 million early in 2021. They have worked diligently to make PSA more modern and competitive. Several athletes were also involved in the acquisitions. For example, Kevin Durant of the Brooklyn Nets, Houston Texans quarterback DeShaun Watson, and former tennis ace Andy Roddick.

At the time, PSA was in trouble. While still easily the leading grading company in the hobby, it had developed a crippling backlog of submissions.

The new ownership felt the need to shake up the company. In July long time CEO Joe Orlando announced his resignation. The sides made a move seem amicable. Joe released a statement that “I’m so proud of everything we’ve achieved as a team at Collectors Universe over the last 20 years. I know this is the right time for me to step aside because the company is stronger than ever.”

However, there are indications that Orlando was pushed aside by the new ownership. His two-decade-long service had been a substantial success. However, the investors seem to have felt that new blood was required to take PSA to the next level.

It should be noted that Orlando denied any discord with the new owners. As he explained, “I know in these situations there are those who are always looking for some sort of dramatic reason of why someone resigned. I’m sorry to disappoint, but there’s no dramatic reason. I’ve been doing this for almost 22 years in August, and I sort of just woke up one day and realized it was time for me to move on. That’s all.”

Nonetheless, it beggars belief that Orlando would leave the company a few months after the buyout coincidentally.

In his stead, Collectors Universe appointed Nat Turner. Nat was one of the movers and shakers behind the investment group which had purchased Collectors Universe earlier in the year.

Turner explained his strategy for rejuvenating PSA: “as a private company, we will have the flexibility to further invest in infrastructure, technology, and R&D to reduce turnaround times and increase operational capacity, while protecting and enhancing the integrity and consistency of Collectors Universe’s best-in-class services.”

In early December, Collectors Universe announced the acquisition of Card Ladder. The platform is a popular one. But, more importantly, it will integrate some of its key features into the Collectors Universe, ummmm….universe.

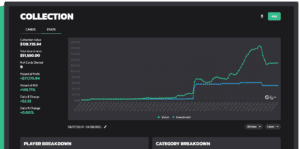

Card Ladder offers real-time tracking of card value. Like many other current platforms, they treat the cards as stocks and express their value fluctuations in a manner familiar to traders. The company has only been around for about a year and a half. Nonetheless, it has become a staple for collectors.

The purchase of Card Ladder fits into the ambitious agenda of Collectors Universe, the owners of PSA, to grow its influence exponentially.

The company was founded by collectors Chris McGill and Josh Johnson in 2020. It is one of many sports card-oriented apps to pop up during the COVID-19 card boom.

Card Ladder tracks the 19,662 most popular cards currently on the market by their reckoning. In addition, it allows users to see the card’s current price and compare it over various time frames. The charts covered in the app hold data for 17 years of sales.

The great thing about Card Ladder is that it provides a definitive answer for comps on a card. If your go-to is eBay, you will find that prices vary wildly depending on the timing of an auction and several other factors. In addition, the values are calculated in real-time, so they are precisely one point when you need to make a transaction.

Also, keep in mind that eBay does not make sales info available for more than three months. Card Ladder tracks information over two years.

When you have the pro-version, Card Ladder will provide the following info on each registered card:

The app also provides you with an overview of your collection. The info and layout are very familiar to stock investors. They include:

The main disadvantage is the limited selection of cards. While 19,000 is nothing to sneeze at, it only covers the most basic investment cards and very little in the way of vintage.

As a personal aside, I have had Card Ladder installed on my phone for months now and have found it incredibly useful.

Nat Turner, the CEO of Collectors Universe, exclaimed, “we’re deeply committed to investing in collection management and pricing tools that provide every collector with the best industry information available. Card Ladder’s sales data, tracking tools, and innovative predictive pricing technology is a great addition to Collectors Universe.”

There is a long history of American companies buying competitors and complementary services to cement an unfair business advantage. Although we have anti-trust laws on the books, they are riddled with holes and seldom forcefully enforced.

The problem has also been evident in the hobby. Some notable examples include Topps buying out Bowman back in 1956 and the Fanatics takeover of the major sports contracts in 2021. So, is the purchase of Card Ladder part of this pattern?

It might be. One of the tools on Card Ladder is a population report, which is currently a service limited to “Pro” members. Members willing to pay the $15 fee can access the following valuable data:

The company includes population reports for all of the significant graders presently. In addition, the prevalence of Card Ladder helps to keep population reports diversified.

The PSA agenda is very different. They hope the term “pop report” means the number of cards graded by PSA and not the other companies. The further along PSA is on that process, the closer they come to making the other graders irrelevant.

The folks at Collectors Universe have denied that this will be a problem. In their statement on the acquisition, the company insisted, “will continue to remain agnostic with regards to data sources, grading companies and pricing to provide unbiased and transparent information for all collectors.”

We have already discussed the way PSA use set registries as a tool to increase its business. Not surprisingly, Collectors Universe plans to make their set registries fully compatible with Card Ladder. In their media statement, the grading empire explained, “will be further integrated into the overall PSA customer experience in the near future, including allowing PSA Set Registry members to see the Card Ladder estimated values for their inventory and sets.”

PSA may indeed avoid very obvious attempts to marginalize the opposition through their new purchase. However, much as Facebook has leveraged the acquisitions of Instagram and Whatsapp, PSA stands to gain a lot through this purchase.

PSA has already taken a pole position in the grading world. As you may remember, the company was so inundated with submissions that it had to halt many of its services.

It has used the time since to work through the submission backlog. However, just as significantly, the grading company has upgraded its capacity and increased the number of graders they have on hand.

The revitalization of the company has been remarkable. On December 22, PSA announced that it had reached a series of benchmarks in freeing up the back catalog.

Their announcement contained the following components:

On December 29, the company announced that its Regular submissions would be completely restored. PSA had previously opened Regular submissions through virtual queuing events.

Now the company has begun to hold Economy submission events. However, they are only open to Collectors Club members for the time being.

The absence of cheaper PSA submission options has only increased the demand for its services. The grading company is dominant right now. The purchase of Card Ladder will tangibly add to PSA’s advantage.

Card Ladder is not the first company PSA has purchased to improve and expand its capabilities. It also will not be the last.

Two significant moves predate this one.

One of the first moves of the investor consortium was to purchase the Long Island NY, based Genamint company. The company has designed impressive grading software. Their program can scientifically analyze centering and corners. Just as important, Genamint claims it can spot alterations and tampering at an exceptionally high level of accuracy.

Their software also creates a virtual “fingerprint” for each card scanned. That way, PSA will be able to spot resubmissions.

PSA does not plan on replacing human graders. Indeed, they have hired a host of new ones. Instead, they intend to supplement their graders with Genamint supplied technology. Turner explained, “Acquiring and integrating Genamint will allow us to grade more trading cards faster while improving accuracy. We’re not eliminating humans from the grading process. Instead, we’re improving the process by adding technology.”

Just a few days before Orlando stepped down as CEO, PSA announced the purchase of Wata Games. The company has long been considered the premier grader of video games.

They became famous for grading copies of The Legend of Zelda and Super Mario 64, which went on to break sales records. If you are curious, the Zelda game went for $870,000 and the Mario for $1,560,000.

The reason for the move is apparent. Video game grading is growing, and Collectors Universe wants in on the loot. Turner said as much: “we’ve identified video games as the next area primed for similar expansion. We’re partnering with Wata because they are the experts in video game grading, and there’s simply no other way to recreate the amazing and trusted company they have built.”

I am no expert on grading video games. However, there is no doubt that Wata Games is an impressive organization. They boast a very precise and well-explained grading system.

They can also grade different formats, requiring more adaptability than card grading. For example, they grade game boxes, cartridges, manuals, and other game-related products.

Not surprisingly, Collectors Universe has taken Wata Games in a classic PSA direction. The video game grading company has recently released its first pop report.

The acquisition of high-tech companies by Collectors Universe will dramatically affect their services in the future. For example, Wata Games is working on a mobile scanning app that will allow you to get information on games from home and perhaps facilitate grading.

You can even access the Wata Games database without an internet connection. Their Matrix technology holds 500 times the amount of data found in a QR code. In addition, each game graded by Wata Games is equipped with cutting-edge chips developed by Canyon Drive Technologies in Boca Raton, Florida.

The ease of communication and storage of data will ultimately revolutionize grading. After all, with the development of digital fingerprints for collectibles facilitated by Genamint technology, there will be few barriers to grading online.

The new PSA model is a hi-tech one. Turner says, “All that stuff is an opportunity for us to create new technology — advance that registry where collection management, real-time pricing, all that stuff is not a strength of Collectors Universe or PSA, and my plan is to be laser-focused on hiring engineers, data scientists. Honestly, I know that stuff. I don’t know a lot in this world, but that stuff, I know pretty well.” With the amount of money now invested in PSA and their technology level, it is hard to see any other grading companies competing.

Do you remember when PSA announced that it was closing submissions for Regular and Economy service? Older players like Beckett and SGC seemed poised to take advantage. In addition, several new grading companies popped up. Remember Snaggletooth Grading, anyone?

Time may prove me wrong, but the other grading companies had a golden opportunity to catch up with PSA when it stopped accepting submissions. But the opportunity has been blown. Instead, PSA appears poised to become a grading monopoly.

The American economy has encouraged hi-tech monopolies in several sectors. Think Apple with cellphones, Amazon with retail sales, and Facebook with social media. Unfortunately, the hobby is also about to be utterly monopolized by Fanatics. There is no reason grading will be any different.

what was Panini doing? 🙄

I compared sports card prices from the big sellers to save YOU money

Is GameStop buying PSA? (the truth!)

I ripped an entire case of Phoenix Football (BIG win or MASSIVE loss?)

Make an extra 30% PROFIT on eBay with this sports card hack

What's your biggest trading card regret? This is a safe space. 🤣

I used ChatGPT to invest in sports cards (and make this thumbnail lol)

Easy hack for buying Tyrese Haliburton rookies at a DISCOUNT.

BCW Thick Card Toploaders 197 Pt. 10 per pack

BCW Thick Card 59 Pt. Toploaders. 25 per pack

BCW 20 Pt. Toploaders. 25 per pack

BCW Standard Card Sleeves. 100 per pack

BCW Thick Card Sleeves. 100 per pack

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

The SAD story of Collectable. What went wrong? (The Downfall Fractional Sports Card Investing)

Cardlines June 18, 2025 3:00 pm