On a crisp evening at American Legends Collectibles in Scarsdale, New York, Michael Rubin stepped into the lion’s den. Facing a room of passionate collectors, he did something unusual for a billionaire CEO: he listened.

And when a concerned collector asked the question on everyone’s mind — how Fanatics would prevent breakers from dominating the market and pricing out average collectors — Rubin didn’t deflect. We were surprised to see Michael Rubin address concerns on breakers and pricing.

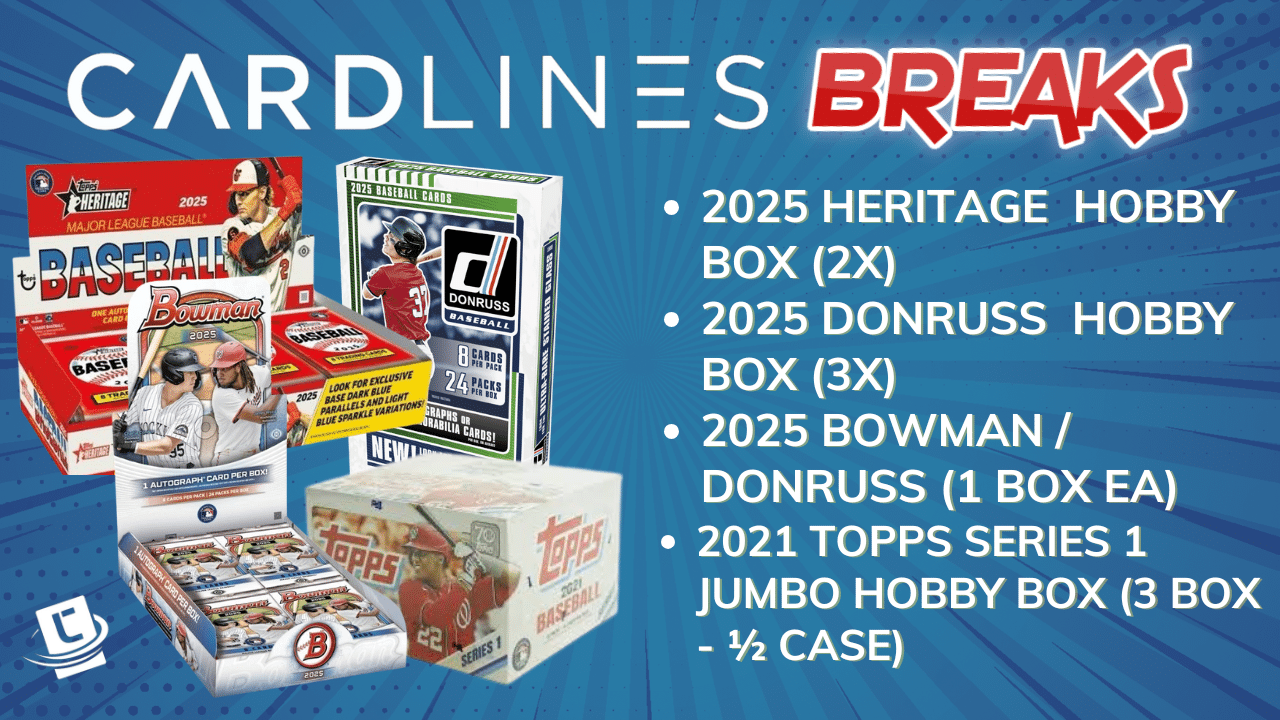

Instead, he offered a surprisingly transparent breakdown. Twenty percent of cards go to retail, 40% to hobby shops, 40% to breakers.

He acknowledged the widespread suspicion that cards might be “stacked” for breakers, and promised an audited process as transparent as an NBA draft. It was a masterclass in corporate communication: part data, part empathy, and a clear recognition that the future of the sports card hobby hangs in a delicate balance.

But transparency doesn’t solve everything. As Rubin himself admitted, every solution creates new problems. More on-card autographs mean higher demand. More cards mean potential overprinting. And through it all, the fundamental question remains: Can Fanatics keep the hobby accessible while also making it profitable?

Michael Rubin’s transformation of the sports card industry began with a bold strategic move in January 2022 when Fanatics acquired Topps for approximately $500 million.

This wasn’t just a simple purchase but a calculated takeover that gave Rubin’s company exclusive trading card rights for major sports leagues including MLB, NBA, and NFL. The acquisition brought roughly 350 global Topps employees, instantly elevating Fanatics from a merchandise company to a serious player in the collectibles market.

The momentum continued in May 2023 with the acquisition of PWCC Marketplace, one of the world’s largest sports card and collectibles auction houses. This strategic purchase allowed Fanatics to consolidate the sports card resale market, integrating PWCC’s robust marketplace directly into their Fanatics Collect platform.

Rubin effectively reshaped how sports cards are bought, sold, and traded by controlling both the primary and secondary markets.

At the core of Rubin’s strategy is a valuation that speaks volumes: Fanatics was valued at $31 billion in a December 2022 funding round, with Rubin personally owning approximately 33% of the company.

This isn’t just a business; it’s an empire built on understanding the intersection of sports fandom, collectibility, and digital marketplace dynamics. Rubin has positioned Fanatics to be more than a merchandise company—he’s creating a comprehensive sports collectibles ecosystem.

The company’s Topps Rip Nights have been a big success. Michael Rubin showed up to one of them, held at the American Legends Collectibles store in Scarsdale, New York. There, he talked to young collectors and participated in the fun. To his credit, Rubin took questions from collectors.

The first question he answered was one that is on everyone’s mind. A concerned collector asked, “How is Topps/Fanatics going to help the average consumer, still be able to get cards, without breakers gobbling them all up. I wanted to get a hobby box of Series 1, but the night before the release, I watched breakers get all the big hits. The biggest hits possible. The cards that I was looking to chase, I can’t chase them anymore, because somebody already got them.”

Rubin is a consummate professional who immediately used the “this is a phenomenal question” technique, which puts the crowd at ease and gives you time to think of an answer. With those chops, he can run for the Senate.

But Rubin gave a very detailed answer. He said that about 20% of the cards they make go to retail stores like Walmart and Target. Then 40% go to hobby shops, and another 40% go to breakers. He continued, “People believe that cards are stacked for breakers. You see this on social media all the time.”

Rubin checked this process with an auditor and believed people had a right to know, “just like the NBA draft process.” Therefore, he wants to ensure that “cards are going where we say they are.”

Then there is the influence of breakers on prices. The same individual said that with breakers buying so many boxes at high prices, “they are pricing me out.”

He added, “pricing and keeping the products affordable is critical.” He noted that for Fanatics, the people who buy at retail stores, the local card stores and the breakers are all important legs of their business model. Therefore, “what we are trying to do is to make sure that we have products for each area and that we are thinking of how to get prices down. The problem is, the consumers hate redemptions. We have reduced redemptions by 98%, right? Where there used to be hundreds of thousands of redemptions, we have hundreds of thousands. The love on-card autos, and they hate sticker autos. Therefore, so many more of the autos are now on-card. Then people say we want Wemby autos, we want Jayden autos, so we go out and create the debut patch and all these things. That creates much energy. The problem is that the prices go up because of more demand. But then if you make more cards.”

He trailed off. However, that, I believe was him implying that in those cases Fanatics gets accused of overprinting cards. Therefore, Rubin concluded, “it’s a delicate balance because keeping the hobby accessible is vital to us.

Rubin handled the question well and showed us the complex considerations that go into the Fanatics strategy.

One datapoint we were unaware of is the percentage of products sold through each source. We now know that the numbers break down to about 20% for retail and 40% each for breakers and local card stores.

He notably did not say what percentage Topps sells directly. Which raises the question, is that considered part of retail, or did he not include it in the analysis? That is important because there have long been suspicions that Fanatics is trying to prioritize direct sale at the expense of other ways of purchasing cards.

But then there is another issue. It is highly likely that Rubin’s numbers breakdown significantly underestimates what breakers are getting. It may be that, as Rubin says, only 40% of the population will be recognized breakers.

However, since it is a big money maker, many local card stores also do breaks and are likely forwarding a good portion of their best products to that. Therefore, those boxes would be listed as going to local card stores. But that would be an inaccurate classification.

Then there is always the chance that shops are selling boxes to breakers and they may be picking up some extra through retail. Meanwhile, breakers usually don’t sell to anybody but rather rip product on camera. Therefore, it wouldn’t be shocking if the breaker share was closer to 50% than 40%.

Another interesting thing that Rubin said, was he addressed the role of the breakers in the hobby as providing the products with free (from his perspective) hype and advertising.

They do indeed drive excitement and attention towards the new products since it helps them fill spots. Of course, the sad part, is that while the hype is free for Fanatics, consumers are ironically paying for it.

We are paying for hype for products that then raise the prices of what we buy. The breakers do so by driving up demand and drying up supply. So, they act as a truly inflationary pressure on the sports card market.

The support Fanatics is giving to breakers rubs some people the wrong way. The rise of card breaking has fundamentally transformed the sports card collecting hobby, turning what was once a personal, methodical pursuit into a high-stakes, livestreamed gambling experience.

Breakers have created a new ecosystem where collectors purchase “spots” in a box break, essentially gambling on the chance of pulling a valuable card. During the pandemic, this practice exploded, with collectors buying into breaks that can cost anywhere from a few dollars to hundreds, watching the unwrapping live and hoping for a rare hit.

The problems with this model run deep. Many collectors and industry insiders argue that breaking has essentially gamified card collecting, transforming it from a hobby of passion and preservation into a speculative market rife with potential manipulation.

Indeed, there are widespread suspicion that breakers are rigging the system, with many believing that big breakers are getting significantly better odds than those advertised by card manufacturers.

Moreover, [ESPN] has highlighted a critical legal gray area, noting that these breaks technically fall under “illegal forms of gambling” despite their popularity.

The most damning criticism comes from collectors who see breaking as a predatory practice that benefits breakers enormously while leaving most participants with worthless cards, with one forum user bluntly stating that breaking is “re-skinned gambling that is creating greedy degenerates who are ruining the hobby in every which way.”

The entire project of Topps Rips Nights is an attempt to repair the troubled relationship between fanatics and local card stores throughout America.

In its earlier days in the hobby, many small retailers viewed the company as an existential threat to their business model. The fear many of them had was that Fanatics aimed to systematically cut out every intermediary between manufacturers and customers, effectively crippling wholesalers, distributors, and local card shops.

The company’s aggressive expansion strategy, which includes acquiring Topps and securing exclusive licensing deals with major sports leagues, has left many local shop owners feeling cornered and powerless.

The tension was further amplified by Fanatics’ strict guidelines for card and hobby shops selling Topps products. These policies severely limit local shops’ ability to compete, as they cannot match Fanatics’ prices or availability.

Some industry insiders saw this as a deliberate strategy to squeeze out traditional retailers. The New Republic described the conflict as a battle where “the wholesome hobby gets sucked into the antitrust wars,” highlighting the potentially devastating impact on small, independent card stores that have been the heart of the collecting community for decades.

Michael Rubin’s commitment to the sports card hobby is complex. On one hand, he’s making genuine efforts to address collector concerns: reducing redemptions by 98%, pushing for more on-card autographs, and attempting to create transparency around product distribution.

But the numbers remain troubling. With 40% of products going to breakers and another 40% to hobby shops (many of which also do breaks), the average collector is still fighting an uphill battle. Rubin acknowledges the delicate balance between making products exciting and keeping them accessible, but acknowledging the problem isn’t the same as solving it.

His Rip Night appearance shows he’s listening — and that counts for something. He’s not hiding behind corporate walls, but actively engaging with collectors. Yet the fundamental tension remains: Fanatics’ business model relies on creating buzz and demand, which inevitably drives prices up.

Is Rubin trying to help local card stores and regular consumers? Probably. Is he fully succeeding? Not yet.

0:58

0:58

The best small town card shop? 👀

Sports Card Scavenger Hunt! (5,000 Subscriber Special!)

I hit a SWEET auto from the #1 overall pick at PCB hobby

The Ultimate 2024 Football Card Brand Tier List (Panini vs. Topps and more!)

2025 Topps All Star Game Mega Box Product Review

Ripping the new Topps All Star Game mega box.

Is this new sports card store the BEST VALUE around?

I Tested eBay Auction Promotions So You Don’t Have To!

2022 Topps Heritage Baseball Blaster Box Configuration: 7 Packs per Box – 9 Cards per Box. Plus 1 extra pack.

Keep up on breaking Sports Card News, our latest articles, product specials and exclusive content with expert analysis of hobby trends.

© Copyright 2025 - All rights reserved Cardlines.com / Media Techs LLC - Sports Card News, Reviews, Releases and BREAKS - #thehobby.

Important: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

Top 5 Sports Card Athletes to invest in RIGHT NOW (big ROI potential!)

Cardlines 7 hours ago